How does a digital experiment born from cryptographic theory evolve into a trillion-dollar asset class that simultaneously promises financial liberation and delivers spectacular volatility? The answer lies in a peculiar journey that began with David Chaum‘s 1983 proposal for cryptographic electronic money—a concept so prescient it would take another quarter-century to find its killer application.

The foundational work emerged through a series of academic exercises that seemed destined for obscurity. Wei Dai’s “b-money” and Nick Szabo’s “bit gold” introduced proof-of-work mechanisms in 1998, while the NSA (perhaps inadvertently) contributed significant cryptographic research on anonymous electronic cash.

Academic theories gathering dust in obscurity became the unlikely foundation for a financial revolution that would reshape global economics.

These disparate threads converged when Satoshi Nakamoto published the Bitcoin whitepaper in 2008, proposing a peer-to-peer electronic cash system with an audacious 21-million coin supply cap. The genesis block’s mining in January 2009 marked cryptocurrency’s changeover from theory to reality.

Early adopters like Hal Finney participated in primitive transactions, while one particularly optimistic individual famously purchased pizzas for 10,000 BTC—a decision that would later represent roughly $600 million in foregone gains, depending on market conditions.

Bitcoin’s open-source architecture spawned an ecosystem of alternatives. Namecoin and Litecoin introduced technical variations, while Peercoin pioneered hybrid consensus models combining proof-of-work with proof-of-stake mechanisms.

Privacy-focused projects like Zcash and Monero implemented zero-knowledge proofs and ring signatures, addressing surveillance concerns that traditional cryptocurrencies couldn’t resolve.

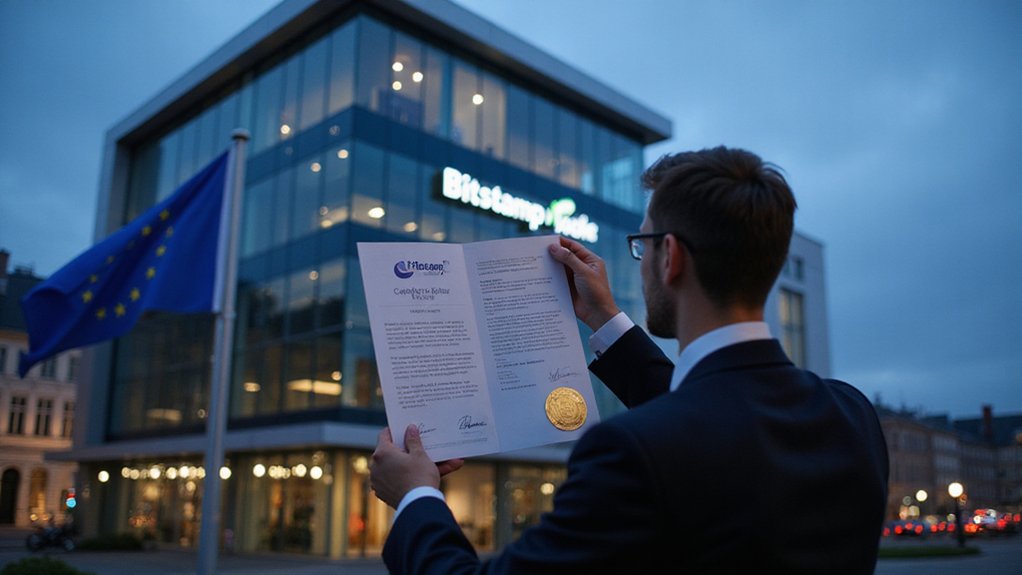

The technological evolution paralleled market expansion. Early exchanges like New Liberty Standard facilitated price discovery, while mining reward halving events—occurring approximately every four years—created artificial scarcity that attracted institutional attention. The Mt. Gox security breach in 2014 highlighted the need for mature wallet technology and proper insurance protections across cryptocurrency exchanges.

The introduction of smart contracts enabled programmable transactions, birthing decentralized autonomous organizations and expanding cryptocurrency’s utility beyond simple value transfer. Ethereum’s network launched in July 2015, marking the transition from simple digital currency to comprehensive blockchain computing platforms. The landscape transformed dramatically with the 2024 approval of Bitcoin ETFs, signaling mainstream financial acceptance and institutional legitimacy.