How often does Congress manage to pass legislation that simultaneously clarifies a murky regulatory landscape while potentially reshaping the entire monetary system?

The GENIUS Act—a somewhat grandiose acronym for “Guiding and Establishing National Innovation for U.S. Stablecoins Act”—achieved precisely this feat, passing the Senate with a decisive 68-30 vote and establishing the first thorough federal framework for dollar-pegged stablecoins.

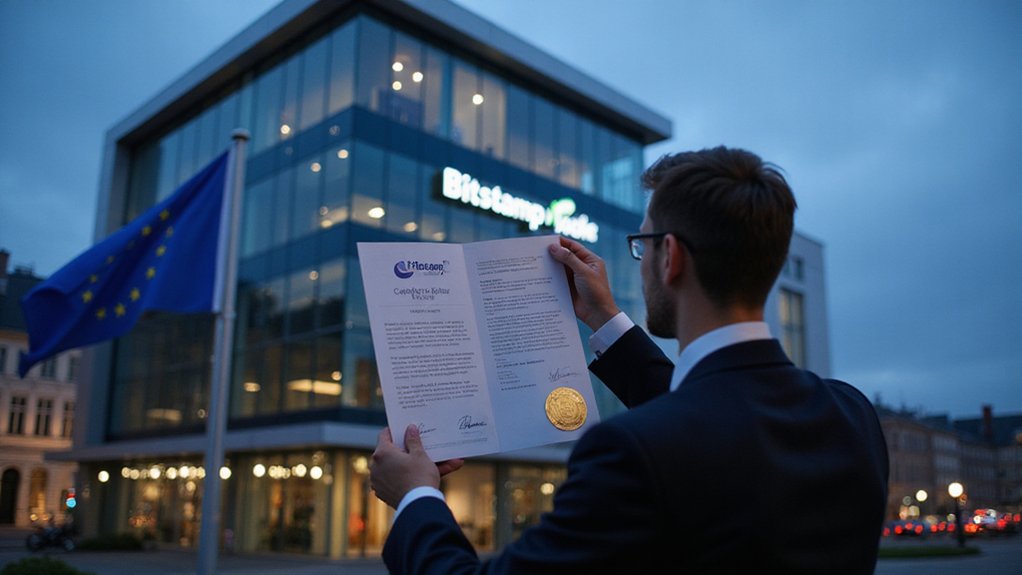

Congress delivers rare regulatory clarity with the GENIUS Act’s decisive Senate passage, establishing America’s first comprehensive federal framework for stablecoins.

The legislation’s architecture reflects a strikingly pragmatic approach to digital asset regulation.

By restricting stablecoin issuance to insured banks, credit unions, and qualified federal or state entities, Congress effectively eliminated the regulatory Wild West that previously characterized this $230 billion market.

Perhaps more importantly, the Act explicitly defines compliant stablecoins as non-securities, removing them from SEC oversight—a jurisdictional clarification that industry participants have sought for years.

The reserve requirements represent the Act’s most substantive consumer protection mechanism.

Issuers must maintain 100% backing through cash or high-quality liquid assets (U.S. Treasuries and short-term bills), with monthly audits ensuring transparency.

This 1:1 backing requirement, coupled with priority repayment provisions during bankruptcy proceedings, addresses the fundamental trust deficit that has plagued algorithmic and fractionally-reserved stablecoins.

Enforcement mechanisms carry genuine teeth: unauthorized issuance triggers penalties up to $1 million and five years imprisonment per violation.

The dual regulatory framework allows smaller issuers (under $10 billion) to choose state oversight while larger entities fall under OCC supervision, creating regulatory scalability without compromising standards. Critically, the legislation preserves tokenized deposits as a separate category, allowing traditional banks to issue digital currency equivalents without navigating the new regulatory requirements.

The economic implications prove equally fascinating.

Industry projections suggest the stablecoin market could expand from $230 billion to $1.6 trillion by 2030—a sevenfold increase driving approximately $1 trillion in new Treasury purchases. This regulatory clarity provides investors with the stable parking space they need to navigate volatile crypto markets with greater confidence.

This demand surge may lower government borrowing costs through yield compression, though economists warn that such growth could complicate Federal Reserve monetary policy transmission. Interest payments on the national debt have nearly tripled from $345 billion in 2020 to $881 billion in 2024, underscoring the potential fiscal benefits of reduced borrowing costs.

The Act’s foreign issuer provisions, requiring regulatory equivalence certification, demonstrate measured internationalism without sacrificing sovereignty.

Whether this framework ultimately enhances financial stability or merely institutionalizes systemic risk remains an open question, but Congress has at least provided clarity where chaos previously reigned.