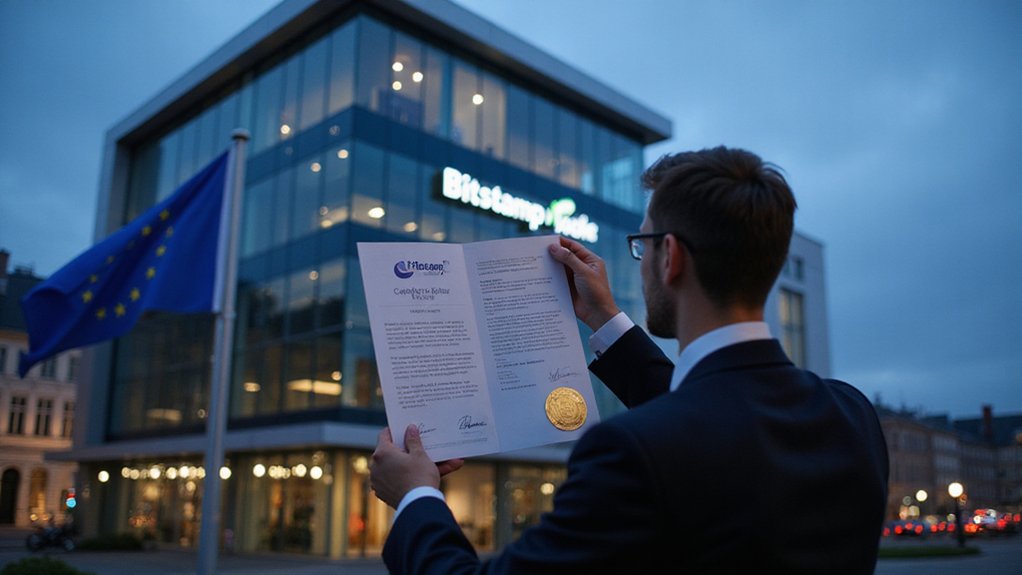

In a watershed moment for cryptocurrency regulation in Europe, Bitstamp has secured the coveted Crypto Asset Service Provider (CASP) license under the European Union’s Markets in Crypto-Assets (MiCA) framework—a regulatory milestone granted by Luxembourg’s Commission de Surveillance du Secteur Financier.

This achievement positions the exchange among the vanguard of crypto platforms embracing the EU’s harmonized regulatory landscape, a development that would have seemed improbable during crypto’s wild west era.

The CASP license empowers Bitstamp to legally execute orders and provide custody services across all 27 EU member states, leveraging the bloc’s vaunted “passporting” mechanism—that peculiar European innovation allowing financial entities to traverse national boundaries with remarkable regulatory efficiency.

Regulatory unicorns now roam Europe’s crypto landscape, galloping effortlessly across national borders with MiCA-approved passports in hoof.

For an industry accustomed to maneuvering a labyrinthine patchwork of country-specific regulations, this represents something of a bureaucratic unicorn. This regulatory achievement is particularly noteworthy as Bitstamp stands as the first exchange in Luxembourg to receive this authorization.

Bitstamp’s regulatory courtship isn’t newfound; the exchange has maintained a consistent trajectory toward legitimacy since securing a payment institution license in 2016, followed by a MiFID license earlier this year.

This methodical accumulation of regulatory credentials culminates in the MiCA approval, reinforcing its self-styled image as one of the most compliant exchanges globally (a rather low bar, some might say, in an ecosystem where regulatory disdain has often been worn as a badge of honor). The company proudly presents itself as longest-running crypto exchange globally, a claim that underscores its staying power in a notoriously volatile industry.

The timing is particularly significant given Robinhood’s $200 million acquisition of Bitstamp in June—a transaction that now appears rather prescient.

By satisfying MiCA’s stringent AML and KYC requirements, Bitstamp has effectively secured pan-European operational clearance while competitors remain mired in jurisdiction-by-jurisdiction approval processes.

For European crypto traders and institutions, this development promises a more seamless trading experience under the aegis of thorough investor protections.

The exchange can now expand its service offerings with regulatory certainty, potentially catalyzing broader institutional adoption across the continent.

In an industry where regulatory clarity has been as elusive as sustained bull markets, Bitstamp’s MiCA license represents that rarest of crypto commodities: legitimate progress.

This achievement stands in stark contrast to the situation in the United States, where many crypto companies face debanking challenges under regulatory pressures reminiscent of Operation Choke Point.